General information of Smart Pro CAP

Disclaimer!

This project is supported by the European Union Programme Hercule III (2014-2020). This programme is implemented by the European Commission. It was established to promote activities in the field of the protection of the financial interests of the European Union. For more information see here.

This communication reflects the view only of the author, and the European Commission cannot be held responsible for any use which may be made of information contained therein.

What is Smart Pro CAP?

Smart Pro CAP - Smart Protection of EU financial interests in the field of CAP was leaded by the Agricultural Registers and Information Board (ARIB) of the Republic of Estonia and brought together four Paying Agencies from different European countries with the aim of sharing different smart data-based practices that would help to protect EU’s financial interests. Smart Pro CAP Project is financed by the Hercule III Programme of the European Anti-Fraud Office (OLAF).

The project lasted 15 months (from 1.01.2021 to 31.03.2022) and consisted of four staff exchange study visits to each contributing country.

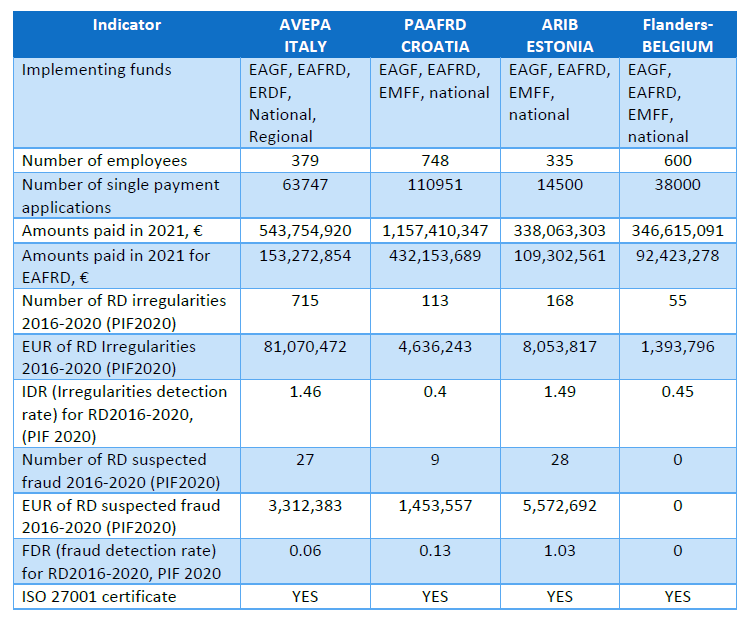

Project partners include the following Paying Agencies:

- ARIB - Agricultural Registers and Information Board of the Republic of Estonia

- AVEPA – Agenzia Veneta per Pagamenti (Italy)

- PAAFRD – Paying Agency for Agriculture, Fisheries and Rural Development (Croatia)

- VO – Dept.LV - Flemish Paying Agency – Department of Agriculture and Fisheries of the Government of Flanders (Belgium)

The context of the Smart Pro CAP project

Multiple sources like CAFS 2019, PIF REPORT 2019(AGRI), a special report of ECA no 01/2019, and the EU legal framework for CAP control systems set the context for the Smart Pro CAP project. Needs arose from the context:

- Sharing best practices and know-how of using data-driven risk analysis while implementing CAP by the Members States and their paying agencies.

- Enhance cooperation between the Member States and Commission focusing on developing data-driven anti-fraud actions in order to use the full potential of data-driven risk analysis for detection and prevention of irregularities and fraud purposes.

Objectives and results of Smart Pro CAP project

A general objective of the project was to contribute to greater use of data-driven risk assessment for increasing the efficiency of protection of the EU financial interests in the field of CAP expenditures in anti-fraud processes.

The specific objectives of Smart Pro CAP were:

- Mapping the best practices among participating countries and know-how of using data-driven risk-analysis while implementing CAP by the Member States and their Paying Agencies including used methods, software (such as Arachne) and resources.

- Pointing out the main challenges for further exploiting the full potential of the data-driven anti-fraud measures.

- Initiating the constant cooperation and networking between Member States for promoting wider use of data-analytics based protection of the EU financial interests in CAP expenditures.

The project consisted in the organisation and implementation of Study visits to the participating Paying Agencies in order to collect and share best practices and to document those events according to a pre-agreed structure. These exchanges paved the way to the compilation of a final document that can be further disseminated – a final Compendium of ideas on experiences of using data-driven approach and ARACHNE risk scoring tool.

- As expressed by all participating countries in the project (contributing countries and a representative from the European Commission DG AGRI anti-fraud correspondent and guests from Lithuanian and Latvian paying agencies as guests on the final seminar - this format of sharing best practices has a great way to ignite new ideas of finding new ways for sound management of the EU funds and protection of the EU financial interests.

- During the project, the different practices were mapped, how the data-driven approach was implemented for sound management of the EU funds. Both, classical and modern AI-based approaches were observed which all were also explained in the final compendium. A very important precondition of the data-driven approach is an organisational setup that should support and encourage steps toward the data-driven protection of EU financial interests.

- In all contributing agencies, some types of integrated systems were launched, supporting a data-driven approach. Data-driven organisation and strategy since 2016 in Flemish-Belgium, one integrated IT system for all different EU aid measure schemes in Croatia, a holistic approach and integrated anti-fraud system in AVEPA (Italy), and the holistic risk-management system as part of the management process of agency in Estonia.

- As the general goal was to contribute to the greater use of the data-driven approach, this project also mapped 5 classical and 8 modern opportunities of data-driven methods and potential for the future, which was more than expected at the beginning of the project.

Specific objectives achieved

- best practices of data-driven approaches were mapped,

- fundamental issues that needed to be addressed while benefiting the maximum from a data-driven approach was also mapped,

- strong and committed networking was grounded between contributing and guest paying agencies and DG Agri (EC).

Additionally, the project focused on contributing to the ideas, of how to improve the focus and usability of Arachne for CAP funds.

Public documents and deliverables of Smart Pro CAP

- Date: 29-30 September 2021

- Venue: Brussels (Belgium)

- Title: Opportunities of using data analytics and AI in non-IACS EAFRD measures to shift towards a more risk-based control system and to prevent the risk of overfunding.

- Date: 20-21 October 2021

- Venue: Zagreb (Croatia)

- Title: Experience of Using Data analytics in risk analysis for the protection of EU financial interests for prevention purposes.

- Date: 17-18 November 2021

- Venue: Padua (Italy)

- Title: State-of-the-art and future perspectives for the protection of EU financial interests through data analysis

- Date: 18-20 January 2022

- Venue: Tartu (Estonia)

- Title: Experiences of using data-driven risk analyses experience for non-IACS EAFRD measures and piloting the use of Arachne for daily processes. The glimpse into the future of data-driven agriculture and the DG AGRI expectations for the next CAP period regarding the protection of the EU financial interests.

| Nimetus | Lisatud |

|---|---|